Getting My Pvm Accounting To Work

Getting My Pvm Accounting To Work

Blog Article

Not known Details About Pvm Accounting

Table of ContentsTop Guidelines Of Pvm AccountingThe Greatest Guide To Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Only Guide to Pvm AccountingPvm Accounting Can Be Fun For EveryoneLittle Known Questions About Pvm Accounting.

Make sure that the audit process conforms with the regulation. Apply called for construction accounting criteria and procedures to the recording and coverage of construction task.Understand and maintain basic expense codes in the accounting system. Interact with different financing companies (i.e. Title Business, Escrow Firm) pertaining to the pay application process and needs required for settlement. Handle lien waiver disbursement and collection - https://www.goodreads.com/user/show/178444656-leonel-centeno. Display and solve bank concerns including cost anomalies and check distinctions. Assist with implementing and keeping inner economic controls and treatments.

The above declarations are meant to explain the basic nature and degree of job being carried out by individuals appointed to this classification. They are not to be construed as an exhaustive checklist of duties, responsibilities, and skills called for. Employees may be required to perform obligations beyond their typical responsibilities from time to time, as needed.

10 Easy Facts About Pvm Accounting Explained

You will certainly help support the Accel team to make sure distribution of successful on schedule, on budget, tasks. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building Accountant does a variety of audit, insurance coverage conformity, and job management. Works both separately and within specific departments to keep financial documents and make specific that all documents are maintained current.

Principal duties include, however are not restricted to, taking care of all accounting functions of the business in a prompt and exact manner and offering records and timetables to the company's certified public accountant Firm in the prep work of all economic statements. Makes certain that all accounting treatments and features are handled precisely. Accountable for all monetary documents, payroll, financial and everyday procedure of the bookkeeping feature.

Functions with Job Managers to prepare and upload all month-to-month invoices. Generates monthly Work Expense to Date reports and working with PMs to integrate with Task Supervisors' budgets for each task.

Rumored Buzz on Pvm Accounting

Efficiency in Sage 300 Building and Realty (previously Sage Timberline Office) and Procore construction monitoring software application a plus. https://ameblo.jp/pvmaccount1ng/entry-12853215450.html. Have to likewise be efficient in other computer software program systems for the preparation of reports, spreadsheets and other audit evaluation that might be required by monitoring. construction accounting. Need to possess strong organizational skills and capacity to focus on

They are the financial custodians who make certain that building jobs continue to be on budget, follow tax obligation laws, and maintain monetary transparency. Building accounting professionals are not simply number crunchers; they are strategic partners in the building process. Their key role is to manage the monetary elements of building jobs, making sure that sources are allocated efficiently and financial risks are minimized.

Pvm Accounting Can Be Fun For Everyone

By keeping a tight hold on job financial resources, accountants aid avoid overspending and economic obstacles. Budgeting is a cornerstone of effective construction jobs, and construction accounting professionals are instrumental in this respect.

Navigating the complicated internet of tax laws in the construction sector can be challenging. Building accounting professionals are skilled in these laws and guarantee that the task abides by all tax obligation requirements. This includes handling payroll tax obligations, sales taxes, and any kind of other tax obligation responsibilities particular to building and construction. To master the duty of a building and construction accountant, people need a solid instructional foundation in audit and financing.

In addition, qualifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Market Financial Expert (CCIFP) are very pertained to in the sector. Building jobs usually involve limited target dates, transforming laws, and unexpected expenditures.

The smart Trick of Pvm Accounting That Nobody is Discussing

Specialist certifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate competence in building and construction accountancy. Ans: Building accountants create and monitor spending plans, recognizing cost-saving chances and making sure that the job remains within spending plan. They additionally track expenditures and projection monetary needs to prevent overspending. Ans: Yes, building and construction accountants manage tax obligation conformity for construction tasks.

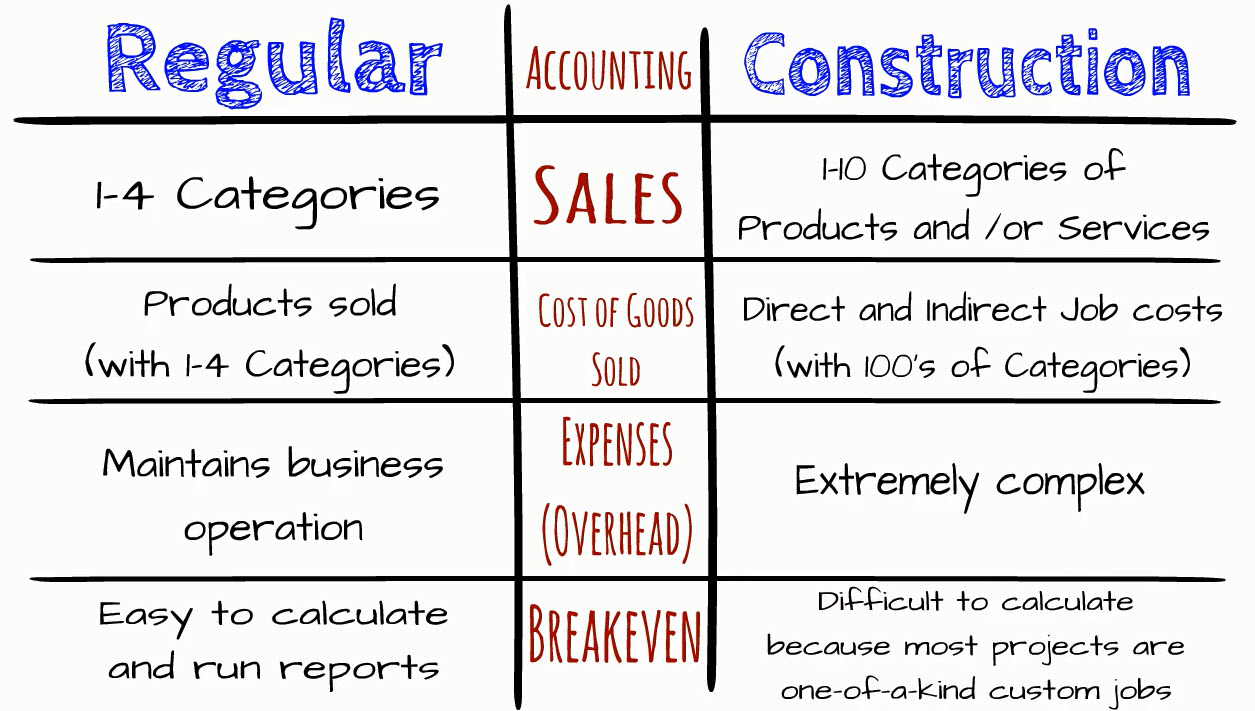

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among several financial choices, like bidding on one job over one more, selecting funding for materials or tools, or setting a task's revenue margin. Go Here On top of that, building and construction is an infamously volatile sector with a high failure price, slow time to settlement, and inconsistent cash money flow.

Production includes duplicated processes with quickly recognizable costs. Production calls for different procedures, products, and tools with varying costs. Each task takes place in a brand-new area with varying site problems and unique difficulties.

Pvm Accounting Fundamentals Explained

Lasting partnerships with vendors relieve arrangements and boost efficiency. Inconsistent. Regular usage of different specialty service providers and providers influences performance and money circulation. No retainage. Settlement gets here in complete or with normal settlements for the complete agreement quantity. Retainage. Some part of repayment may be withheld until project conclusion also when the service provider's job is completed.

While typical manufacturers have the advantage of controlled environments and maximized manufacturing processes, building and construction companies have to regularly adapt to each brand-new project. Also rather repeatable jobs call for modifications due to website conditions and other factors.

Report this page